Mindblown: a blog about philosophy.

-

Why I'm A Tesla Bull Through And Through: Earnings Preview

This article was written by 4.22K Followers Follow I’m a retired Wall Street PM specializing in TMT; since kickstarting my career, I’ve spent over two decades in the market navigating the technology landscape, focusing on risk mitigation through the dot com bubble, credit default of ‘08, and, more recently, with the AI boom. In one…

-

Tesla (NASDAQ: TSLA) Stock Price Prediction and Forecast 2026-2030 (Jan 15)

Tesla Inc.’s (NASDAQ: TSLA) share price rose about 4% but then gave up that gain in the past week. CEO Elon Musk announced that the company’s self-driving software would transition to a monthly subscription model, and rumors suggest Tesla is preparing to enter the Estonian and Latvian markets. Tesla stock is still 38.6% higher than…

-

Wall Street results live: Goldman and Morgan Stanley herald best year for US investment banks since 2021

Client Challenge JavaScript is disabled in your browser. Please enable JavaScript to proceed. A required part of this site couldn’t load. This may be due to a browser extension, network issues, or browser settings. Please check your connection, disable any ad blockers, or try using a different browser.

-

India’s trade deficit with China widens as Beijing hits record $1tn trade surplus despite Trump tariffs

New Delhi: India’s trade deficit with China has widened in the last year as Beijing’s trade surplus surged to hit a record $1.19 trillion in 2025, with the world’s second-largest economy continuing to expand its exports to other parts of the world despite heavy US tariffs. India’s deficit in the first nine months of 2025-26…

-

Stock market today: Nasdaq futures lead Dow, S&P 500 higher as TSMC's strong outlook buoys AI hopes

Intel (INTC) got its second upgrade this week on Thursday as Citi (C) analysts raised their rating on the stock to Neutral from Sell. Analyst Atif Malik said that supply tightness in TSMC’s (TSM) packaging business would be a tailwind for the US chipmaker. Packaging refers to when a finished chip is wired up and…

-

Valero Energy (VLO) – Among the Best High Yield Crude Oil Stocks to Buy After Trump’s Blitz in Venezuela

Artificial intelligence is the greatest investment opportunity of our lifetime. The time to invest in groundbreaking AI is now, and this stock is a steal! AI is eating the world—and the machines behind it are ravenous. Each ChatGPT query, each model update, each robotic breakthrough consumes massive amounts of energy. In fact, AI is already…

-

Top Energy Stocks Poised for Gains: WarrenAI Highlights Value Opportunities

Investing.com — Energy stocks present compelling value opportunities according to recent analysis from WarrenAI, which identifies three standout performers with significant upside potential, strong cash flow yields, and high analyst conviction. The energy sector, despite recent volatility, contains several undervalued companies that combine growth potential with attractive valuations. WarrenAI’s analysis focuses on companies demonstrating resilient…

-

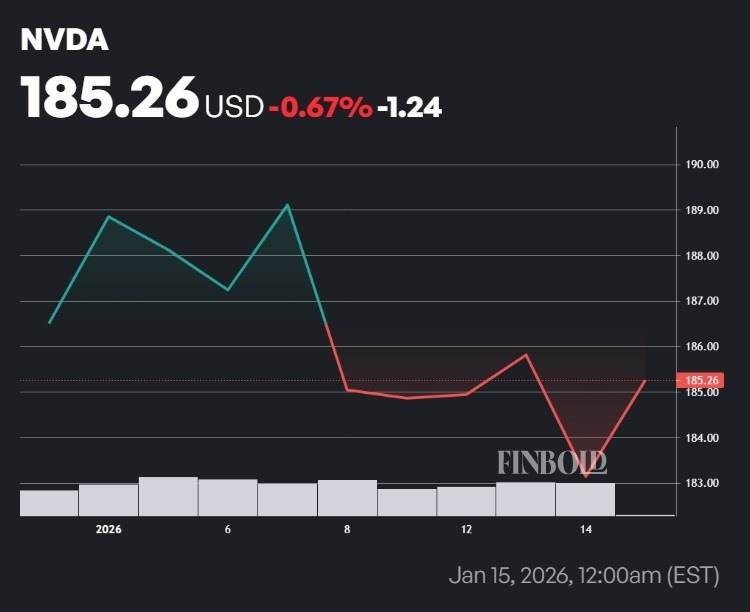

Did China just kill Nvidia stock momentum for 2026?

Unlike the benchmark S&P 500 market index, which is up 0.99% year-to-date (YTD), Nvidia (NASDAQ: NVDA) stock is down 0.67% so far in 2026, and recent developments from China might be to blame. NVDA stock YTD price chart. Source: Finbold Specifically, one of the bullish catalysts for the semiconductor giant at the tail-end of 2025…

-

How dual share classes could reshape the future of ETFs

The SEC’s green light for dozens of investment firms to offer ETF share classes of traditional mutual funds has opened new avenues for active vehicles built in the tax-efficient structure. Processing Content Even before the Securities and Exchange Commission approved the so-called dual share classes for 30 fund companies — including BlackRock, JPMorgan Chase, Fidelity…

-

Rare Earths, Energy And Crypto: Themes ETFs Expands Leveraged Lineup With Six New Funds

Leverage Shares by Themes is amplifying single-stock trading. The ETF issuer on Tuesday rolled out six new leveraged single-stock ETFs, giving traders 2x daily exposure to a mix of clean energy, critical minerals, defense tech and crypto-mining names. The funds aim to deliver twice the daily performance of their underlying stocks, whether the market is…

Got any book recommendations?